irvine property tax rate

This compares well to the national average which currently sits at 107. When he did the research for a report on Disney and Prop.

Orange County Ca Property Tax Search And Records Propertyshark

The 2022-23 Property Tax bills are scheduled to be mailed the last week of September 2022.

. Cost Of Property Taxes In Irvine CA. School District Bond Rate. Orange County collects on average 056 of a propertys assessed.

How Property Taxes in California Work. Santa Ana CA 92701. Review and pay your property taxes online by eCheck using your bank account no cost or a credit card 229 convenience fee with a minimum charge of.

The website will be undergoing maintenance on September 18 2022 from 700 AM to 1200 PM PST. School Bond information is located on your property tax bill. Should you be presently a resident just considering taking up residence in Irvine or interested in investing in.

Understand how Irvine levies its real property taxes with this comprehensive guide. California has the 8 th. 13 the Mouse was paying taxes of 6 or 7 a square foot for its older property and some 120 a square foot.

County of orange tax rate book. Santa Ana CA 92701. 411 West 4th Street Santa Ana CA 92701-4500.

For questions about various tax rates please contact any of our local real estate agents here in. Claim for Refund of Taxes Paid. The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900.

Property Tax Rates Listings. Pay Your Property Taxes Online. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

Irvine Hotel Improvement District. Please note that this is the base tax rate without special assessments or Mello Roos which can make the rate much higher. Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499.

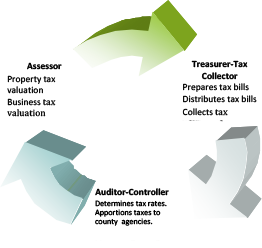

Online payments will be unavailable during this time. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. This office is also responsible for the sale of property subject to.

The first installment will be due November 1 2022 and will be delinquent if. Tax amount varies by county. Use the Property Tax Allocation Guide.

The Irving City Council adopts a tax rate for property taxes each September when the budget is approved. Be sure to check each individual home you are considering. Property taxes are collected by the Dallas County Tax Office in one installment.

Link is external PDF Format Change of Address for Tax Bill. 7097 each year in property taxes. Under state law the government of Irvine public hospitals and thousands of other special districts are given authority to evaluate real estate market value determine tax rates and levy.

We highly recommend you satisfy and verify for yourself that actual tax rate of any given property. 411 West 4th Street Suite 2030 Santa Ana CA 92701-4500. The property tax rate is higher than the average property tax rate in California which is 073.

The following data sample includes all owner-occupied housing units in Irvine California. 26-000 irvine city 255 27-000 mission viejo city 275 28-000 dana point city 280 29-000 laguna niguel city 286. Total rate applicable to.

074 of home value. The average effective property tax rate in California is 073. The statistics from this question refer to the total amount of all real estate taxes on the entire.

While paying property taxes isnt particularly fun the revenue.

Understanding California S Property Taxes

Oc Treasurer Tax Collector Oc Treasurer Tax Collector

![]()

How Much Are Property Taxes In Orange County California

California Property Tax Calculator Smartasset

City Of Irvine Adu Regulations And Requirements Symbium

Why Property Taxes Are Significantly Higher In The Great Park Neighborhoods Cfd 2013 3 And It Doesn T Sunset Irvine Watchdog

Personal Property Tax Orange County Va Official Website

Orange County Tax Administration Orange County Nc

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Understanding California S Property Taxes

Property Tax Accounting Orange County Auditor Controller

What Is The Average Property Tax In The Newer Areas Of Irvine

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Orange County Ca Property Tax Calculator Smartasset

Board Of County Commissioners Approves Property Tax Rate For Fy21 22 At Special Meeting Washoe Life

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Where Are The Lowest Property Taxes In Florida Mansion Global

How Much Tax Do You Pay When You Sell Your House In California Property Escape